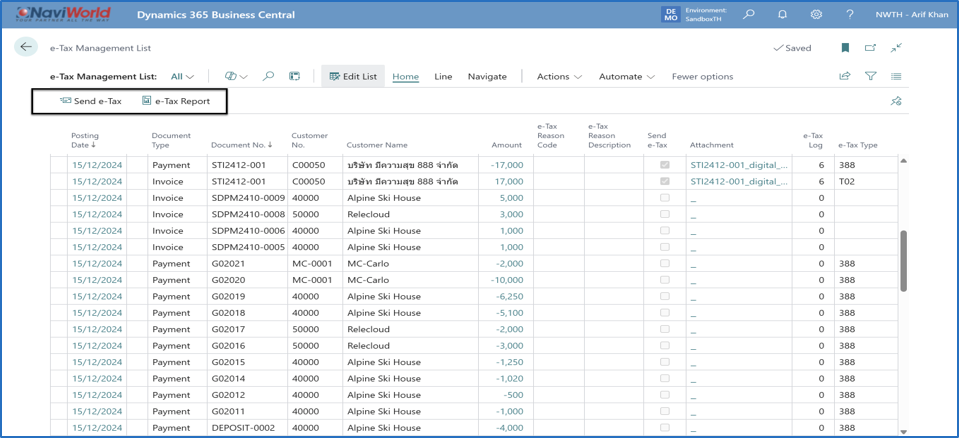

Streamline Your Invoicing with NaviWorld’s E-Tax Solution for Microsoft Dynamics 365 Business Central

Easily comply with the Thai Revenue Department’s legal requirements for electronic invoicing. Our solution for Dynamics 365 Business Central automates and simplifies your entire E-Tax Invoice and Receipt process, saving time and ensuring full regulatory compliance

Why E-Tax for Business Central?

The Thai Revenue Department (RD) has introduced the E-Invoice and E-Receipt system to modernize tax compliance and improve efficiency. This initiative encourages businesses to adopt secure, paperless electronic invoicing to ensure tax compliance